In February 2019, a year before COVID-19, in a relatively stable low-interest rate environment IDAD launched their first Callable Deposit Plan into the UK retail market.

This product has recently matured paying investors 62.44% over a six year term with capital protection. This is the highest structured product deposit return for almost ten years.

Impressive returns and product structure

The product was issued by Goldman Sachs as a six-year deposit with quarterly issuer call opportunities after one year. If the product is called the investor receives a return equal to 8% per annum (not compounded). If, as was the case, the product was not called and reached maturity the payoff to investors was equal to three times the growth in the FTSE 100 index.

The growth in the index over the product term was approximately 20.82% and therefore this product paid 62.44% which is equivalent to a return of 8.42% per year – higher than the fixed callable return.

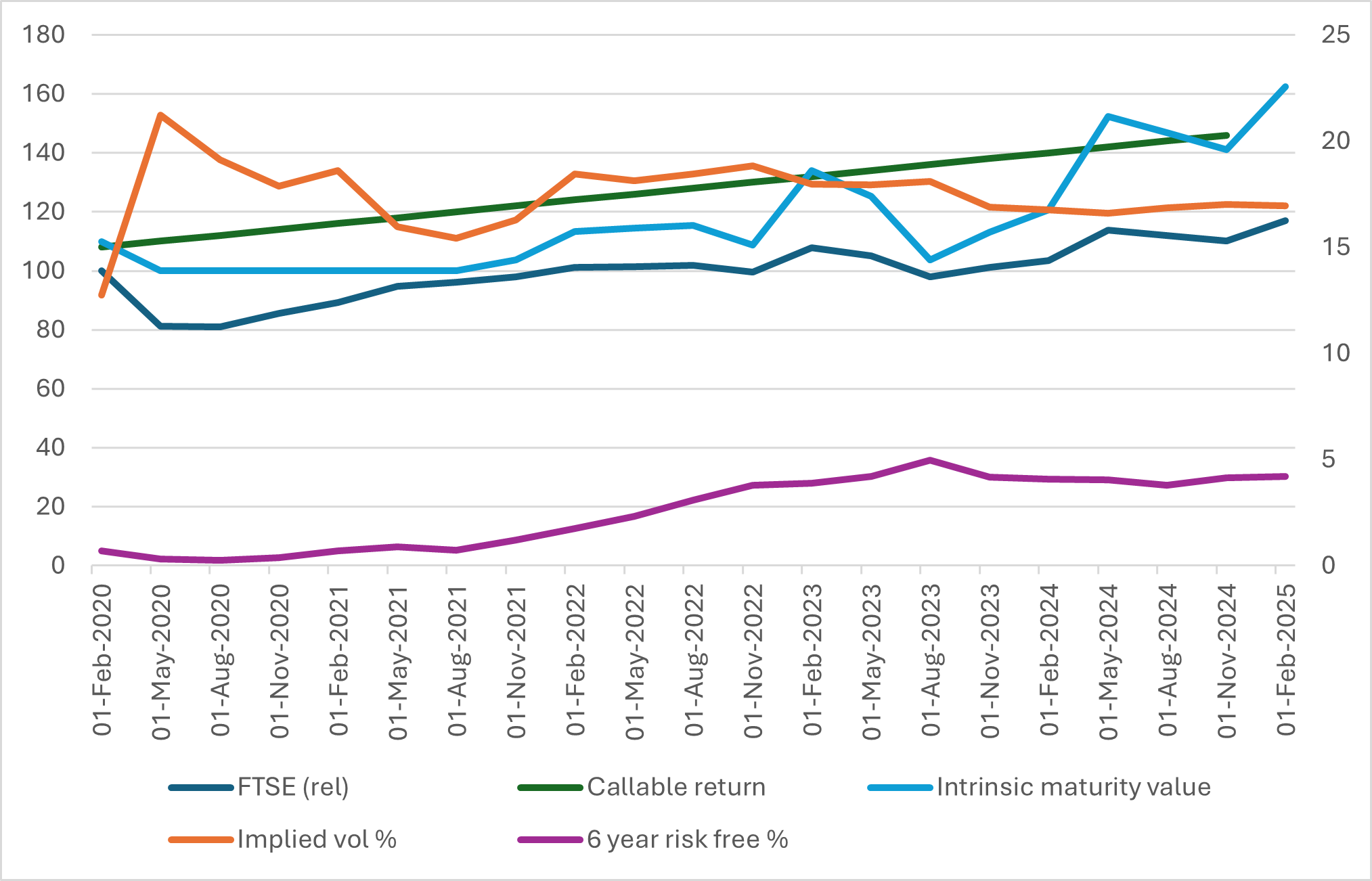

Figure 1 shows a number of key metrics that are useful to gain insight into the product’s performance through its life. Source: FVC / IDAD product terms.

Each metric is shown as of the quarterly observation dates of the product. The straight line indicates the callable payment amounts that would have been paid at each point, equivalent to 8% per year plus capital investment. The intrinsic maturity value is the amount that would be paid if the product was at maturity given prevailing index levels i.e. the capital investment plus three times the growth in the FTSE 100 index floored at zero. For example if the FTSE 100 index is 10% higher than on the strike date at a given time the intrinsic maturity value at that point would be 130%.

Also shown on the chart are relative FTSE 100 Index performance, GBP six year risk free rate and the one-year implied volatility of the FTSE. These are key inputs into calculating the product value during its life and important factors in determining whether the product is likely to be called by the issuer or not.

In general we expect the issuer to call a product if it is economically beneficial to do so. By this we mean if the fair value of the product taking into account its remaining life on a given call date is higher than the callable return then the issuer should call paying the fixed return. If instead the value of the product is lower than the call return the issuer should not call and let the product continue, since the liability on its books is less than the amount that would be paid out.

The intrinsic maturity value of the product gives a simplistic assessment of the product’s value. The chart shows that on 21 May 2024, one of the later callable observation dates, the FTSE 100 was 17.43% higher than its strike level. If it had been on the maturity date this would have meant a return of 52.28% for investors, which is more than the fixed callable amount for that period of 42%. At that time the product still had nine months to run and had two further callable opportunities. Based FVC’s pricing models the fair market mid-price of the product as of 20 May 2024 was approximately 135%, which is below the fixed call payment and therefore consistent with the issuers decision not to call the product at that time.

The most critical observation point for this product is the final one in November 2024. If the product had been called at this point the product would have paid a healthy 46% return, instead due to a fall in the index just before the call date it was not necessarily optimal to call and the product continued to maturity paying a return of 62.44%, more than the fixed amount because of late further gains by the FTSE-100.

Future of callable deposit plans

There are currently (as of 27 March 2025) 23 structured product deposits open for investment in the UK listed on StructuredEdge.co.uk. There are two equity linked callable products, the latest in this series from IDAD and a similar product from distributor hop investing issued by Societe Generale offering a fixed return at maturity if the index is greater than 85% of its initial level. The remaining deposits are split over autocall, digital, range accrual and fixed income product types showing the appetite for a whole range of deposit structured in the UK.

The latest version of this plan (IDAD Callable Growth Deposit Plan - Issue 21 - April 2025) has an almost identical payoff to the product discussed here and is also offering a potential return of 8% per annum if called or three times FTSE growth at maturity. Although interest rates are significantly higher than they were when issue 1 was released other market factors mean that the terms available for this payoff structure are the same. In February 2019 FTSE implied volatility was at significantly lower levels than today and the implied dividend yield of the index was over one percentage point higher. Both factors reduce the price of options required to generate this payoff cancelling out the effect of the rate rise. The continued issuance of products in this series shows their popularity and success as demonstrated by the strong return of the very first IDAD callable product.

Tags: Structured EdgeImage courtesy of: Alexander Andrews / unsplash.com