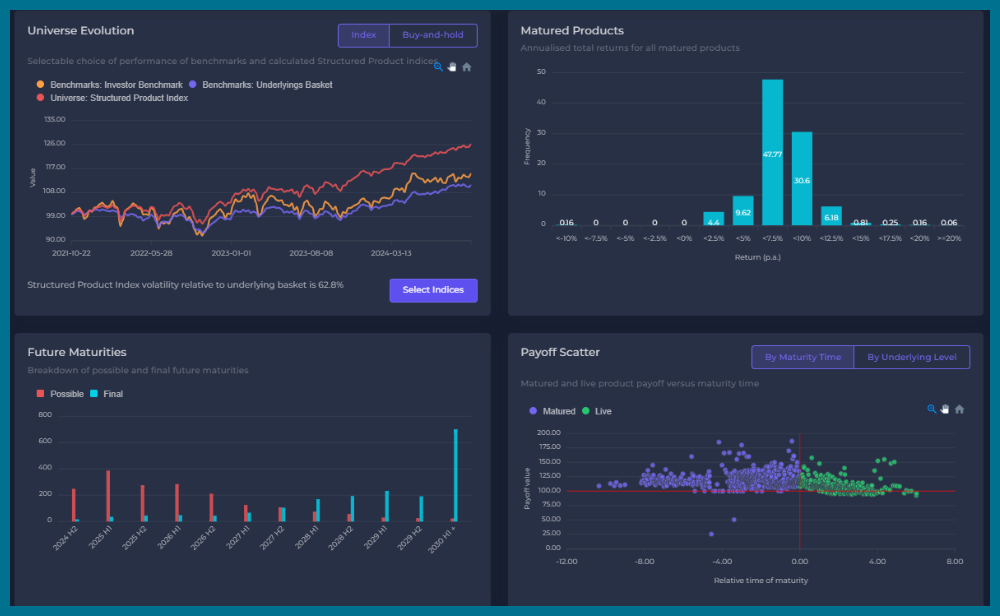

Structured products portfolio metrics

Leading lifecycle analysis for market or client pipeline

Fund solutions design and support

Our core services concentrate on individual structured product stress testing, valuations and analysis. Building on these existing capabilities, FVC has developed innovative techniques for clients to efficiently manage structured products in a portfolio or fund. We believe that sophisticated portfolio solutions will feature heavily in the next phase of growth in the market and we intend to stay at the forefront of that process.

We have provided bespoke solutions for clients addressing the challenges of product selection, associated lifecycle events and re-investment. We have also introduced tools to assess the dynamics of a portfolio or pipeline of structured products.

Our new lifecycle solution can be paired with any individual stress test account or portfolio of structured products. It will also be a central part of an upgrade of the Structured Edge service for the whole UK market. This detailed accurate functionality is an invaluable component of any structured products system. Our solution features advanced portfolio reporting capabilities that we have fully integrated into our technology. This provides a comprehensive breakdown of portfolio metrics with further modules to be introduced in 2025. The lifecycle application is also designed to monitor portfolios and suggest optimal reinvestment opportunities. It can deliver in-depth MI on product issuance and end-client usage for business intelligence and compliance purposes.

In the last ten years, there has been a growth of Structured products funds and separately managed accounts (SMA). These related vehicles present challenges and requirements different to an ongoing pipeline and portfolio that invests wholly or partly in structured products.

FVC has provided bespoke design, valuation and analysis services for many of the leading structured product funds in the UK. This has given us experience in developing a variety of quantitative techniques and strategies. We can calculate metrics to measure fund performance and exposures in a variety of ways.

Away from structured products, FVC uses expertise gained from many years of working with quantitative indices and strategies. These include volatility-controlled, factor indices and those linked to options and futures.

Building on this experience, FVC has been creating solutions for income or growth-seeking funds by some proprietary techniques combining different asset classes. We concentrate on developing easily understood algorithms which have an obvious rationale and show strong performance in different market cycles.

These algorithms tend to produce sustainable income or growth at lower volatility over the long term. As such, they are excellent vehicles for income generation or pension drawdown.

Our services

Stress Testing and PRIIPs

Structured EdgeI offers stress testing and PRIIPs compliance services for structured products and funds, helping clients meet regulatory obligations via our comprehensive API solution

Visit pageIndependent Valuations

NextVal is our independent valuation service for pricing OTC derivatives and structured products. A comprehensive and scalable solution with many use cases and fully supported by our team

Visit pageStructured Edge

Structured Edge is the premier structured products analytics service for financial advisers. It analyses thousands of products across both the UK and offshore markets

Visit pagePortfolio, Lifecycle and Funds

Innovative portfolio and lifecycle management for structured products. Quantitative analysis and expertise for structured product funds and other strategies