Assessing performance of structured products is more complicated than for traditional investments such as funds because of their fixed term nature and the differences between maturity values to in-life valuations. To overcome this, we can consider live products using their current valuation and the final outcomes of product maturities. Both have merit and the best analysis should include a combination of the two. This article will focus on recent product maturities in the UK market and give an overview of the results.

Overview of UK structured product maturities and product type

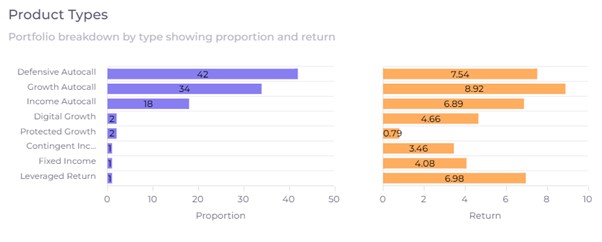

There were 174 product maturities in the UK in the period 01 Jul 2024 to 30 September 2024 (source: StructuredEdge.co.uk). Of these 94% were classified as having at least one autocall opportunity. Defensive autocall made up the largest proportion of maturing products with 42% of the total number. There were only 10 products maturing that had a fixed horizon. None of the products returned a loss and only a single product matured paying the initial investment only. This was the Investec Structured Products EVEN 30 Deposit Growth Plan 74.

The average return for products maturing during the period was 7.48% with an average product maturity of 2.83 years. Only 9% of the maturities were on their final maturity date and the rest were autocall products that have successfully called and therefore matured early.

Figure 1 shows the breakdown of annualised return by product type for matured products over the period. The highest return was for the growth autocall type (which is defined to be a product with at least one autocall point that must be 100% or more of its initial level). These are usually the most aggressive of the three autocall types as both the defensive and income autocalls usually generate returns in the case that the underlying has fallen by up to a certain level.

Underlying index impact

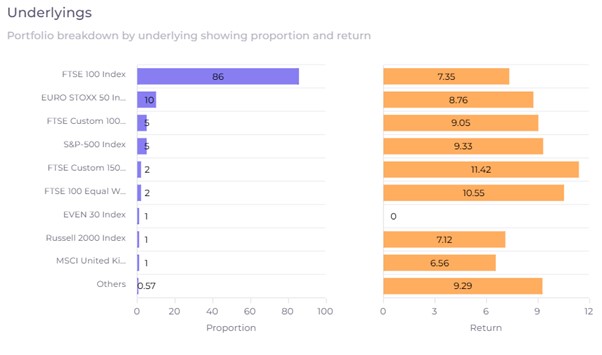

The products maturing during this period were all linked to equity indices either solely or as part of a worst-of combination. The underlyings generating the highest returns were the FTSE Custom 150 Equally Weighted 5% Decrement Index and the FTSE 100 Equal Weight Fixed Dividend Custom Index. Products linked to these underlyings returned on average 11.42% and 10.55% respectively.

Most structured product returns rely on point-to-point underlying change and have defined maturity opportunities. In the UK this is especially true with few products having any American style barriers or in-life properties. The FTSE 100 index is present in 88% of products in the UK and therefore its performance is the most important driver of structured product returns in the UK.

Historical index performance and autocall implications

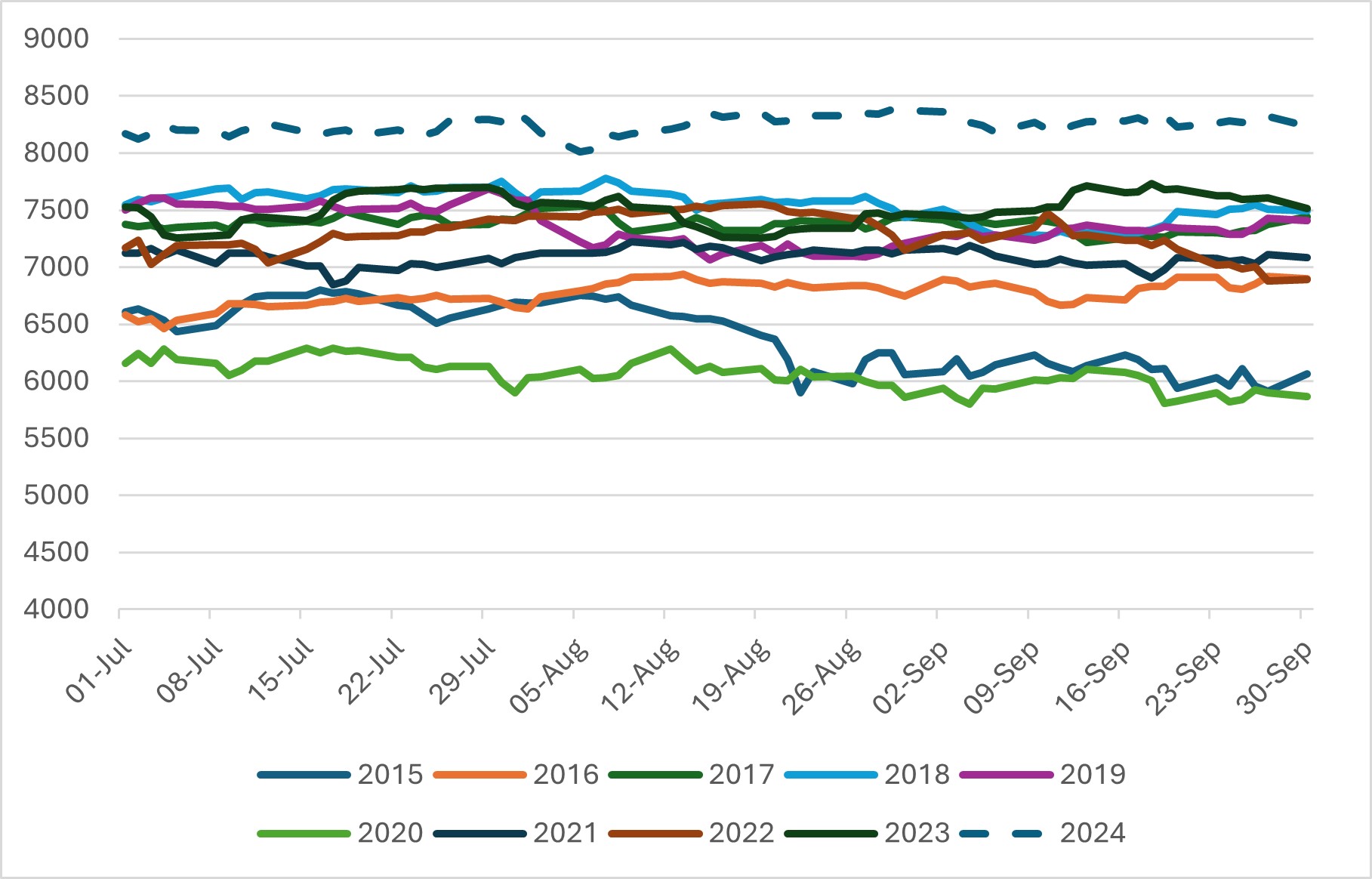

Figure 3 shows the FTSE 100 index level daily for the second quarter of each of the last 10 years.

The index level for July 2024 to September 2024 is shown as a dotted line and is the highest series of all on this chart. The chart shows that the FTSE 100 was higher in Q2 2024 than for the same period at any time over the previous 9 years. Autocall products often have potential maturities at each anniversary so the result of this strong index performance this year is that we expect a large number of products to call successfully since the index level is now well above wherever the product might have struck in the last few years.

In 2018 the FTSE 100 was also relatively high during Q2. Because of this there were a small number of autocall products that struck in July/August 2018 and ran to maturity this year having failed to meet any of the previous autocall dates, as evidenced by the index time series not being high enough on the chart. All these matured with positive returns due to the current FTSE level. Two examples were the Walker Crips Annual Kick-out Plan (UK) Issue 7 and Walker Crips Annual Growth Kick-out Plan Issue 59 that both struck on 17 Aug 2018 and matured on 19 August 2024 paying 151 and 143.5 respectively.

| Capital protected | At risk products |

|  |

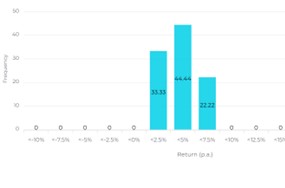

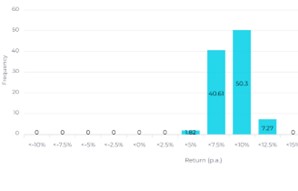

Across both capital types most products returned between 7.5% and 10% per annum. For at risk products the proportion of products returning over 7.5% per annum is approximately 58%. The capital protected returns are significantly lower that the at-risk products as we would expect in a growth market and because of the cost in providing capital protection. The capital protected products were all issued in 2018 when the five year risk-free rate was approximately 1.35% which would have made structuring products with attractive terms difficult.

The UK structured product market is dominated by FTSE 100 linked autocalls. Whilst there is some variation in the market these are often either other product types linked to the FTSE or autocalls linked to other UK market indices.

When the FTSE 100 index is at a relatively high level to previous years there will be more successful autocalling and positive outcomes from fixed maturity products.

Product issuance has been increasing steadily over the past few years allowing for an attractive range of products to replace maturing autocalls in client portfolios and allow clients to continue to benefit from the advantages of the structured product sector.

Tags: Structured EdgeImage courtesy of: David Dibert / unsplash.com