This piece of analysis looks at stock market falls and volatility in early 2020 and examines how UK structured products have fared as a result.

Equity markets have suffered a torrid time in the first quarter of 2020 as fears of global economic contraction due to the disruption caused by the coronavirus pandemic rapidly accelerated.

All major equity indices posted significant falls in this period. The FTSE-100 had reached an all-time high of nearly 7800 in June 2018 and by the end of 2019, when first news of the situation in China was starting to filter through it still stood at over 7500.

Subsequent developments in February and March 2020 produced some very large falls and overall the index lost nearly 24% from the end of 2019 to the time of writing (8 April 2020), standing at a level of 5840. Slightly earlier, on 23 March 2020 it had its lowest close of the year to date, finishing at 4993, down 34% on the year.

Measuring volatility

As well as steep declines overall, 2020 has been characterised by extreme volatility. The biggest one-day fall of the year is 10.9% (12th March) and there has also been a single day gain of 9.0% on 24th March 2020. These are the second highest one day moves in history in both directions - only beaten by a one-day fall of 12.2% in October 1987 and a one-day gain of 9.8% in November 2008.

FTSE-100 volatility for the first three months of 2020 was 44%, compared to an average since 1984 of less than 16%. It is the third biggest distinct peak of volatility in FTSE-100 history, exceeded only in 1987 and 2008. By contrast, the volatility over the final three months of 2019 was a much more typical 13%.

No matter what happens in the rest of 2020, the year’s place in the investment history books is already assured.

Analysing structured products

With these challenging markets it is a good time to review existing structured products in the UK market to see how they are faring.

Capital at risk products are clearly in the more critical position because of the market falls. While fully capital protected products will have their prospects for growth much reduced the capital protection at each product’s upcoming maturity will put them in an extremely strong position relative to most equity based investments currently showing significant losses. There are 315 such capital protected products that are currently active in the UK market, mostly issued as deposits.

Almost all capital at risk structured products have a single “European” barrier level. This means that if the underlying asset is above this level at maturity then investor’s capital will be repaid in full, and potentially with a growth element if markets have recovered.

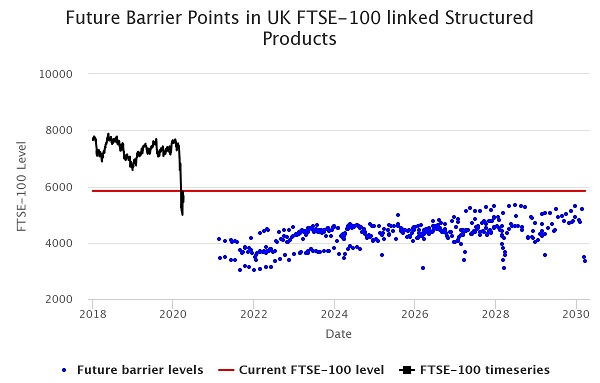

Most structured products issued in the UK are linked to the FTSE-100 only and this study will concentrate on that universe. Data from the UK structured product research service www.structurededge.co.uk shows that 1142 FTSE-100 linked capital at risk products had been issued in the UK market with a final maturity date beyond today. Of those, 376 Autocalls had already successfully called early providing investors with full return of capital and a positive return. This leaves 766 products in force which we will now analyse starting with the chart below.

This chart shows the recent timeline of the FTSE-100 and future barrier risks by date and level for UK structured products.

Barrier levels still low

The first thing to observe from the chart is that all active future barrier levels as indicated by the blue dots are below the current FTSE-100 level as shown by the horizontal red line. The black time series shows the evolution of the FTSE-100 in the last two years and highlights the recent falls.

Therefore even if the FTSE-100 does not recover from its current levels for a long period and simply moves sideways none of the live UK products will lose capital for their investors. This represents a fine achievement for all UK structured product providers in issuing products with significant protection which has even withstood all the market turbulence this year.

The highest barrier level (indicating the product closest to danger) is at a FTSE-100 level of 5331, this is still 9% below the current level and as can be seen from this chart it is many years away, in fact in June 2028.

No short term danger

The first active barrier level is in February 2021, still nearly one year from today. Additionally we note that the highest barrier level for any product maturing before January 2022 is at 4173, nearly 30% below the current level.

Since most observers expect further short term volatility but for markets to eventually stabilise and recover it is a very solid position for the entire structured product market to have no barriers active for another 10 months, and none closer than a further 30% down from today’s levels until 2022.

Conclusion: protection works

We can therefore conclude that if markets move sideways or better not a single FTSE-100 linked UK structured product that is in-force today will lose money. No product is immediately at risk of further short term moves since the first barrier is not active until next year, and no barrier until 2022 is above 4173, a level far below where the FTSE-100 is today.

This robust position across the whole market should be very comforting to structured product investors. Even in such difficult times the sector has stood up to the challenge of capital protection strongly and served its investors extremely well.

A follow-up article, looking at prospects for UK Autocalls has been published here.

Tags: Special Reports Lifecycle Structured Edge