In 2023 and 2024 the European Union launched its Retail Investment Strategy (RIS) and Value for Money (VfM) requirements. Building on existing regulations (such as AIFMD, MiFID II and PRIIPs), RIS seeks to improve investor protection. This initiative will preserve strong protections for individual investors and it also aims to simplify investment procedures.

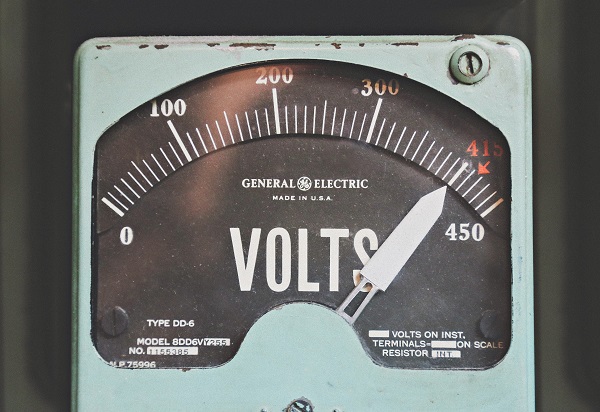

Under new Value for Money principles, investment products should only be distributed to retail clients when they can demonstrate good value. Manufacturers and distributors must be able to show that total costs and charges are reasonable. The two European bodies ESMA and EIOPA have been tasked with developing detailed VfM assessment standards allowing product comparisons across the market and different investment types.

These guidelines will support transparency and they are designed to enable retail investors to make well-informed decisions. The key advancements in RIS include stricter marketing requirements, uniform pricing, improved financial literacy, new measures against conflicts of interest and strengthened supervisory oversight regulations. These changes are intended to provide a more dependable and easily accessible investing environment for retail participants.

From the reaction already seen in the market, these new regulations overemphasise costs while ignoring other elements like long-term performance and investor returns. The proposal to create various VfM benchmarks has been described as too rigid. Controlling and capping fees is clearly an important regulatory function however if applied too strictly it can restrict investment options and stifle innovation. This is an area that must be carefully balanced by policymakers.

Low retail participation in EU capital markets

The level of retail investor activity in EU capital markets is low when compared to other developed economies. Only about 17% of household assets in the EU were invested in financial securities in 2021 compared to roughly 43% in the USA according to EU research. These assets include stocks, bonds, mutual funds and derivatives. This substantial disparity shows why expanding EU retail investment participation is important. The main factor contributing to this discrepancy is that household wealth is primarily held in bank deposits rather than capital market investments. Though their long-term returns are not as high as those of equity and other financial instruments deposits are lower risk. Despite stock markets having mostly experienced strong growth, EU investors are still wary because of perceived risks, complicated regulations and difficulty understanding some investment opportunities. To create wealth more retail investors must participate in capital markets as this would boost the economy. However, for many participating in these investments is challenging due to low financial awareness, onerous regulations and a preference for low-risk savings. While maintaining the crucial protections for investors the EU is acting to remove these barriers wherever possible and appropriate.

Although fund costs in the EU have been gradually declining, they are still high by international standards especially when contrasted with the US. ESMAs 2025 report states that market fragmentation and the existence of many small funds that do not take advantage of economies of scale are the main causes of the inefficiencies in the European fund market. This in turn raises costs. The EU fund market has not yet attained the cost efficiencies anticipated from having a single market with over 50,000 funds and an average fund size that is much smaller than US mutual funds. To improve the competitiveness of EU investment products, ESMA emphasises the necessity of increased transparency and cost savings.

Overcoming obstacles to retail investment growth

In February 2025, EFAMA (the European Fund and Asset Management Association) published their view and of the likely investor journey. This includes disclosures of regulations and choices of investment options and why it often deters investors from entering the market. Clearer information, easier-to-use platforms and fewer bureaucratic barriers would make the market more appealing. The suggested adjustments seek to streamline this process without sacrificing necessary protections. By working together, market players and regulators can create an environment that strikes a balance between accessibility and protection to encourage increased retail participation.

This includes establishing clear disclosure policies, implementing effective financial education programs and ensuring that investment products are understandable to and beneficial for typical investors. Achieving the optimal equilibrium between market efficiency and regulatory supervision will be essential. Although safeguarding individual investors is of high importance overly stringent regulations may restrict both investment opportunities and financial product innovation according to EFAMA.

With these proposed reforms, the EU capital markets are being brought up to date and made more accessible to individual investors. This is an ambitious project which will require a lot of progress to succeed.

As the RIS gets closer to implementation, the primary goals remain improving investor protection, ensuring Value for Money and simplifying the investment environment for retail participants. 2025 will prove to be an important year that will affect the implementation and efficacy of these reforms. Key financial services initiatives are on the agenda for the incoming European Commission but the exact timetable remains unclear and the council's decision how to prioritise RIS under its new Presidency will be crucial. Firms will be keen to make sure that they have adequate time to comply with changes brought about by the RIS.

The effectiveness of the RIS framework in enhancing investor confidence and market participation will take some years to establish. The EU hopes to establish a more vibrant and inclusive investment environment with these measures. The success of these reforms will depend on proper implementation, how the industry adapts and complies and how ongoing oversight can be delivered to make sure they achieve their goals without impeding market expansion.

Tags: RegulationImage courtesy of: Mika Baumeister / unsplash.com