Structured products can be liked to a wide range of instruments spanning all asset classes. The largest share of the global market is taken by equities, with FX and interest rates following and Commodities making up less than 1% of global market share (structuredretailproducts.com). This article will focus on structured products linked to one of the most popular commodities, oil.

Popular oil instruments

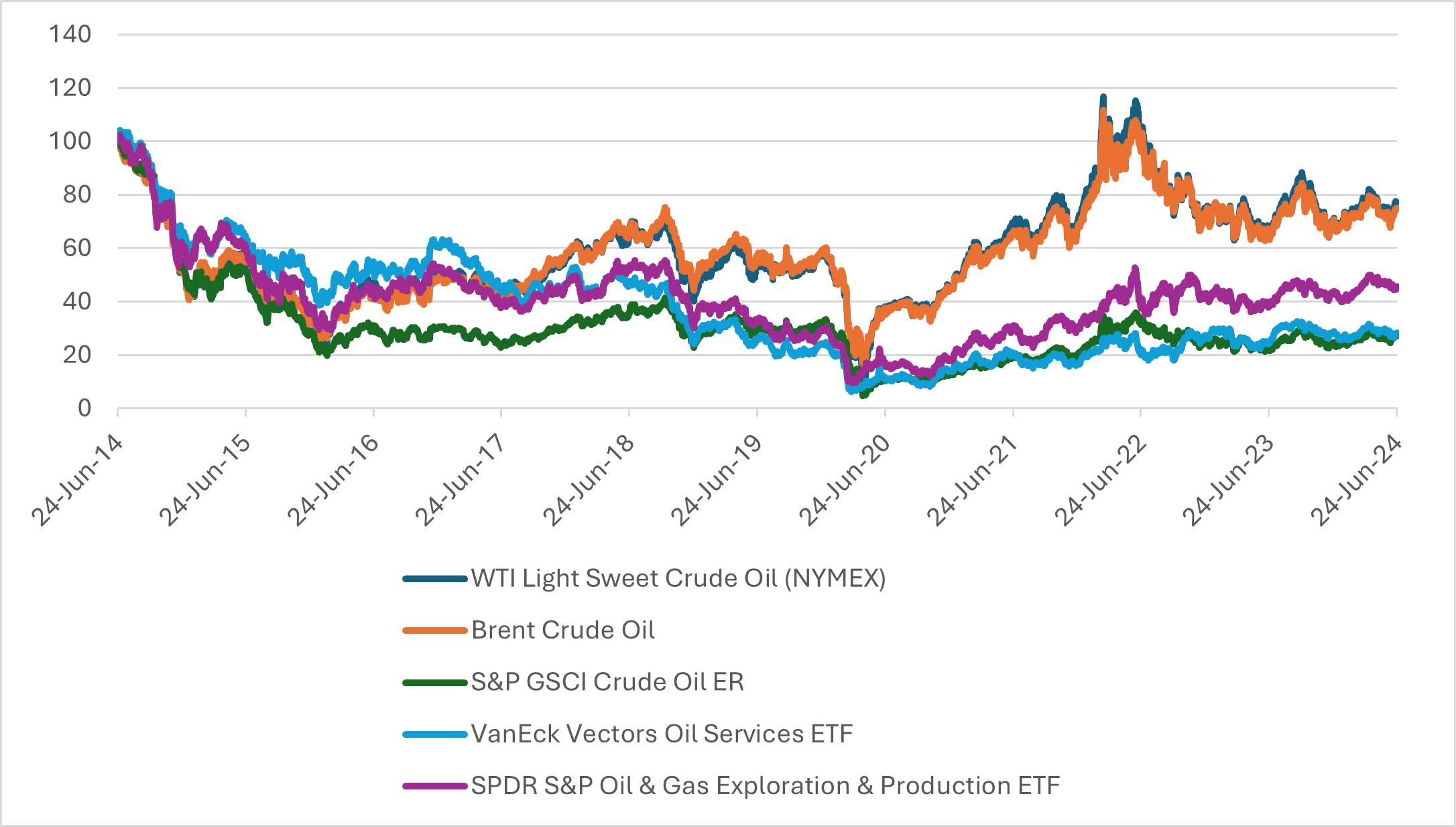

In the US there are a range of product linked to oil through different instruments. Most live products are linked to spot prices or rolling futures contracts such as Brent Crude oil or WTI Sweet Crude oil. Some are linked to indices, the most popular being the S&P GSCI Crude Oil index. This index tracks futures contracts and so is designed to be a benchmark for crude oil performance. There are also several ETFs available including SPRD S&P Oil and Gas Exploration & Production ETF and the VanEck Vectors Oil Services ETF. Unlike the futures contracts or indices these are made up of companies involved in the oil industry. The correlation between these underlyings is shown in figure 2. As one might expect the correlation between the different oil future contracts and the index is very high whereas the ETFs are less correlated since they are as much exposed to the equity market.

| 1 year historic volatility | 5 year historic volatility | Correlation to WTI Crude Oil | |

| WTI Light Sweet Crude Oil (NYMEX) | 28.20% | 60.11% | |

| Brent Crude Oil | 26.73% | 45.25% | 96.98% |

| S&P GSCI Crude Oil ER | 27.65% | 56.96% | 99.54% |

| VanEck Vectors Oil Services ETF | 24.57% | 51.99% | 64.50% |

| SPDR S&P Oil & Gas Exploration & Production ETF | 21.76% | 49.28% | 57.05% |

Case studies in the US and UK markets

The most common product type linked to these five instruments is the digital growth. An example is the one year JP Morgan Buffered Digital Notes – WTI Crude Oil (CUSIP: 48133W5E4) that struck in May 2024. This is a straightforward product paying 12.5% at maturity if the price of the NYMEX WTI crude oil futures contract is greater than 70% of its starting price at maturity. If the underlying finishes at less than 70% of its initial value capital will be lost at a rate of 1:1.452857. This product is a good example of using a structured product to change the payoff shape of an underlying. The product reduces capital risk by use of the buffer and offers a fixed return rather than one proportionate to the performance of the underlying.

By contrast, although the UK retail market is dominated by benchmark regional indices, in particular the FTSE 100 which accounts for 65% of products currently open for investment. Recently IDAD brought an oil linked product to market which was unusual both for being linked to a commodity instrument and for also being linked to something other than an index or ETF.

The 3 year Oil Memory Income Plan May 2024 – Issue 1 is an income autocall plan linked to the NYMEX Division light, sweet crude oil futures contract. The product pays a return of 9.16% per annum provided the underlying is at or above 75% of its initial level on the semi-annual observation dates. There is a memory feature which means that missed coupons will be paid if the coupon conditions are met at a future date. The product will autocall and mature early if on one of the annual observation dates the underlying is at or above its initial level. Capital will be lost if the product reaches the end of the three year product term and the underlying has fallen by more than 50%. This product has been listed on Euro MTF, Luxembourg’s Exchange’s regulated market

The role in investment portfolios

According to the product brochure the underlying is “the world’s most liquid forum for crude oil trading, as well as the world’s largest-volume futures contract trading on a physical commodity.” This makes it a reasonable choice of commodity underlying to offer to the UK retail market. The defensive yield generating nature of this product means that investors will not benefit from strong growth in the underlying but equally risk is reduced through the income, autocall and barrier features.

Investing in oil can be used to diversify a portfolio or may be used as a hedge against inflation. Historically rising oil prices have been a successful indicator of inflation increase due to the direct impact of oil cost in inflation measures and the secondary effect on goods production. By introducing structured products linked to oil investors can use these products as part of the commodity allocation of their portfolio rather than more traditional assets

Tags: Structured EdgeImage courtesy of: Kai Dahms / unsplash.com